Focus on What You Can Control

The recent bank closures are alarming. At times like this, money issues can accelerate emotions. Let's focus on two different aspects of this topic. First, what caused the recent FDIC takeovers? Second, how does this impact personal finances?

#1. Silicon Valley Bank

Silicon Valley Bank (SVB), which catered to the tech industry, failed last Friday. With the nation watching, the Fed has guaranteed that nobody will lose their deposit, even if over the FDIC insured limit of $250,000.

What happened?

With the heavy weighting of tech-driven investors, SVB had garnered billions of deposits. SVB put cash to work by buying long-term Treasuries and Mortgage-backed securities (MBS), backed by the US government.

In a normal inflation environment, that would be considered a safe method of operation. The expectation is that in a normal inflationary period, the longer-term investment is rewarded with a higher rate.

However, this just isn't where our economy is right now. The tech industry has suffered lately. SVP was forced to sell long-term bonds at a $1.8 billion loss when some investors began to request significant cash withdrawals to support their businesses.

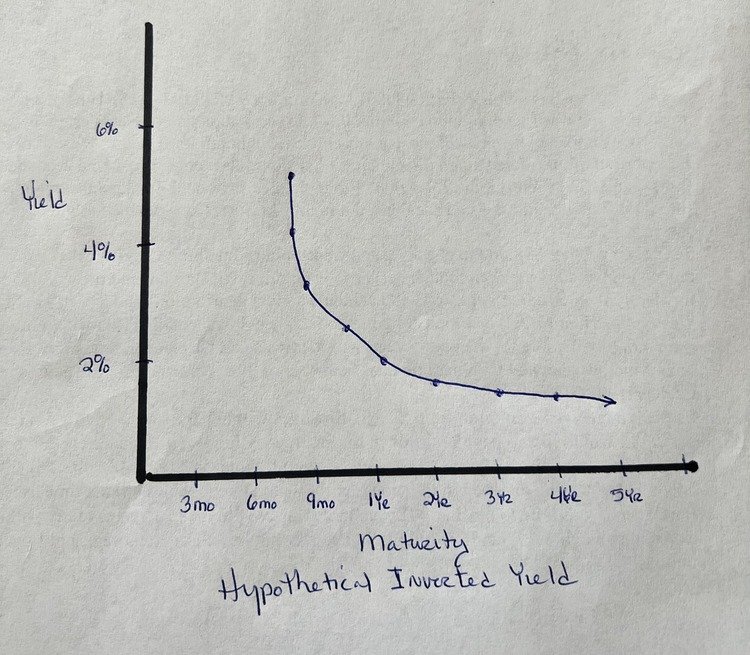

The recent rise in interest rates has caused an inverse bond yield.

Plotted on a yield curve one can see short-term treasuries receive a higher return on investment.

Inverted Yield Curve - Hypothetical

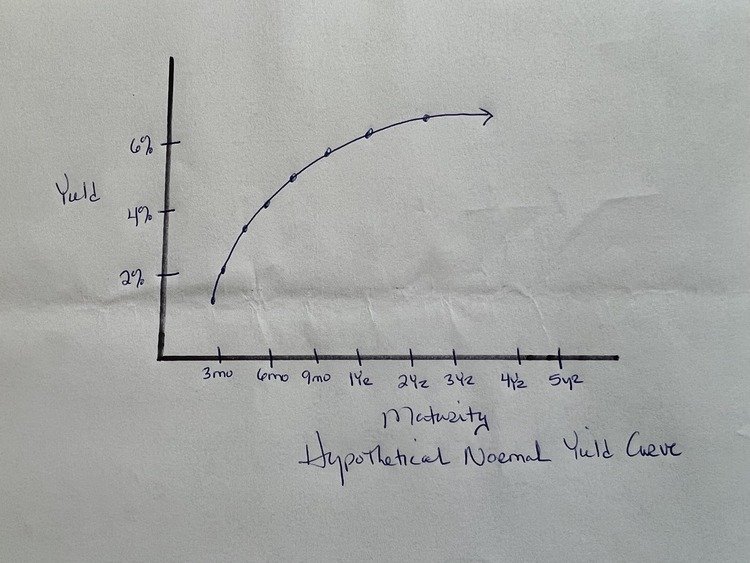

A normal yield curve indicates the longer the duration (investment term), equates to a higher yield.

Normal Yield Curve - Hypothetical

#2. Personal Finance Check Up

When financial uncertainty looms, it's a good idea to go back to the basics. The foundation of good financial decision-making is understanding your budget and building out from there.

Take stock of your income and expenses. Do they align so you can pay all bills as needed?

Do you maintain a sufficient emergency fund? The rule of thumb is to keep 3-6 months of living expenses at hand in a liquid account in case of emergencies.

The failure of SVB is a reminder to be mindful of FDIC insurance limits. Too much cash at hand can put hard-earned cash at risk. FDIC insurance covers $250,000 per tax ID, per account ownership type. Accounts at different banks are insured separately. This does not mean that you can have an account at bank X in town and another in bank X the next town over. Instead, utilize separate banks, such as bank X and bank A. To learn additional information about FDIC Insurance coverage review their guidelines at fdic.gov.

Conclusion

Media headlines cause a lot of stress. Tune out the noise and focus on what you can control. If you have any questions, please reach out to schedule a complimentary appointment.